Après deux ans passés à diversifier ses champs d’action, La Quadrature du Net s’attaque désormais à un nouveau front : la lutte contre le déferlement de l’intelligence artificielle (IA) dans tous les pans de la société. Pour continuer à faire vivre la critique d’une politique numérique autoritaire et écocide, La Quadrature a plus que jamais besoin de votre soutien en 2025.

Depuis plusieurs années, en lien avec d’autres collectifs en France et en Europe, nous documentons les conséquences sectorielles très concrètes de l’adoption croissante de l’intelligence artificielle : à travers les campagnes Technopolice et France Contrôle, ou encore plus récemment avec des enquêtes pour documenter l’impact environnemental des data centers qui accompagnent la croissance exponentielle des capacités de stockage et de calcul.

Une triple accumulation capitaliste

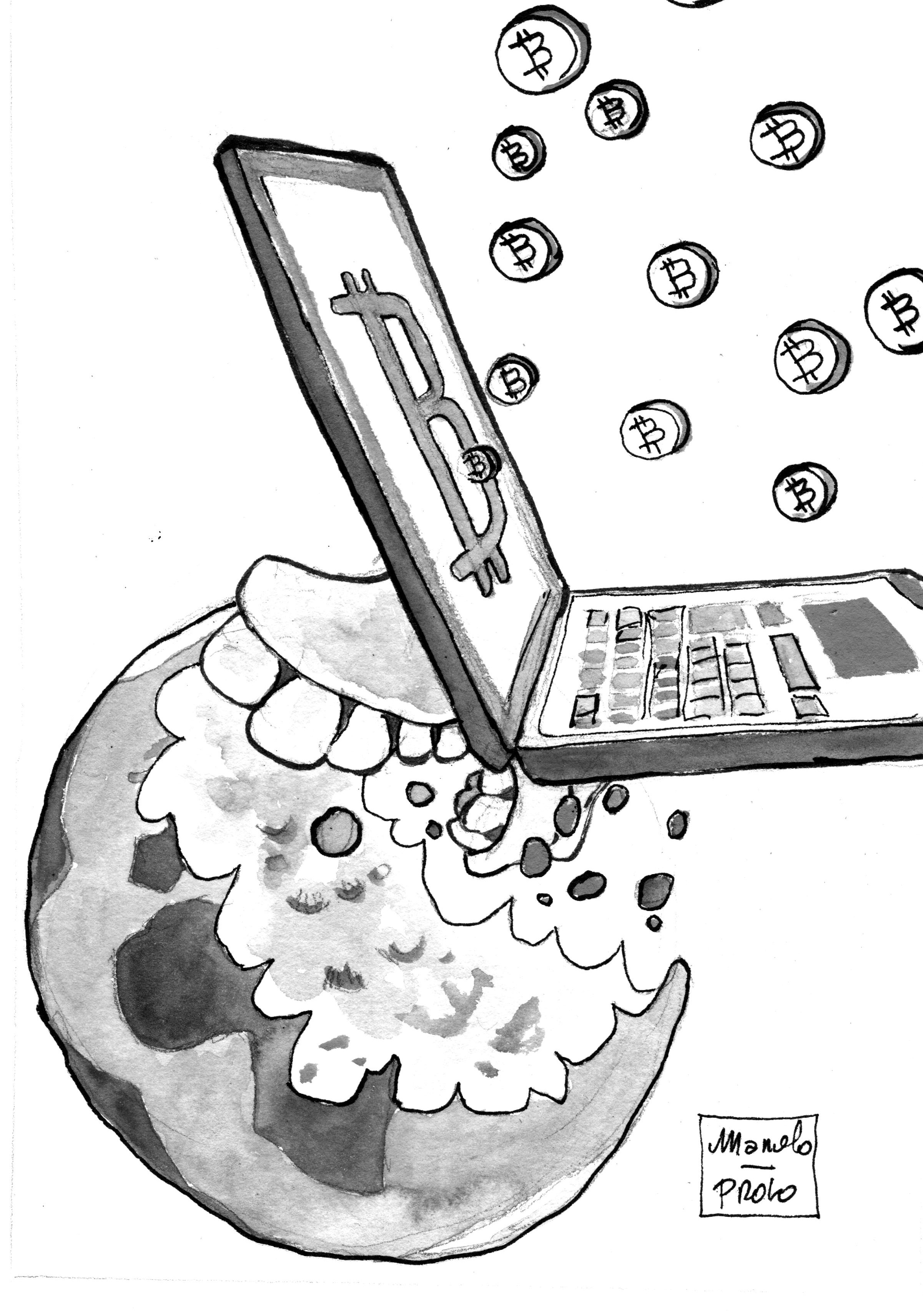

Ces derniers mois, suite à la hype soudaine de l’intelligence artificielle générative et des produits comme ChatGPT, nous assistons à une nouvelle accélération du processus d’informatisation, sous l’égide des grandes entreprises et des États complices. Or, cette accélération est la conséquence directe de tout ce qui pose déjà problème dans la trajectoire numérique dominante. D’abord, une formidable accumulation de données depuis de nombreuses années par les grandes multinationales de la tech comme Google, Microsoft, Meta ou Amazon, qui nous surveillent pour mieux prédire nos comportements, et qui sont désormais capables d’indexer de gigantesques corpus de textes, de sons et d’images en s’appropriant le bien commun qu’est le Web.

Pour collecter, stocker et traiter toutes ces données, il faut une prodigieuse accumulation de ressources. Celle-ci transparaît via les capitaux, d’abord : l’essor de la tech, dopée au capitalisme de surveillance, a su s’attirer les faveurs des marchés financiers et profiter de politiques publiques accommodantes. Grâce à ces capitaux, ces entreprises peuvent financer une croissance quasi-exponentielle de la capacité de stockage et de calcul de données nécessaire pour entraîner et faire tourner leurs modèles d’IA, en investissant dans des puces graphiques (GPU), des câbles sous-marins et des data centers. Ces composants et infrastructures nécessitant à leur tour des quantités immenses de terres et métaux rares, d’eau et d’électricité.

Lorsqu’on a en tête cette triple accumulation — de données, de capitaux, de ressources —, on comprend pourquoi l’IA est le produit de tout ce qui pose déjà problème dans l’économie du numérique, et en quoi elle aggrave la facture. Or, le mythe marketing (et médiatique) de l’intelligence artificielle occulte délibérément les enjeux et les limites intrinsèques à ces systèmes, y compris pour les plus performants d’entre eux (biais, hallucinations, gabegie des moyens nécessaires à leur fonctionnement).

L’exploitation au carré

L’emballement politico-médiatique autour de l’IA fait l’impasse sur les effets concrets de ces systèmes. Car bien loin de résoudre les problèmes actuels de l’humanité grâce à une prétendue rationalité supérieure qui émergerait de ses calculs, « l’IA » dans ses usages concrets amplifie toutes les injustices existantes. Dans le champ économique, elle se traduit par l’exploitation massive et brutale des centaines de milliers de « travailleur·euses de la donnée » chargées d’affiner les modèles et de valider leurs résultats. En aval, dans les organisations au sein desquelles ces systèmes sont déployés, elle induit une nouvelle prise de pouvoir des managers sur les travailleur·euses afin d’augmenter la rentabilité des entreprises.

Certes, il existe des travailleur·euses relativement privilégié·es du secteur tertiaire ou encore des « classes créatives » qui y voient aujourd’hui une opportunité inespérée de « gagner du temps », dans une société malade de la course à la productivité. C’est une nouvelle « dictature de la commodité » : à l’échelle individuelle, tout nous incite à être les complices de ces logiques de dépossession collective. Plutôt que de libérer les salarié⋅es, il y a fort à parier que l’automatisation du travail induite par le recours croissant à l’IA contribuera, en réalité, à accélérer davantage les cadences de travail. Comme ce fut le cas lors des précédentes vagues d’informatisation, il est probable que l’IA s’accompagne également d’une dépossession des savoirs et d’une déqualification des métiers qu’elle touche, tout en contribuant à la réduction des salaires, à la dégradation des conditions de travail et à des destructions massives d’emploi qualifiés — aggravant du même coup la précarité de pans entiers de la population.

Dans le secteur public aussi, l’IA accentue l’automatisation et l’austérité qui frappent déjà les services publics, avec des conséquences délétères sur le lien social et les inégalités. L’éducation nationale, où sont testées depuis septembre 2024 et sans aucune évaluation préalable, les IA « pédagogiques » d’une startup fondée par un ancien de Microsoft, apparaît comme un terrain particulièrement sensible où ces évolutions sont d’ores et déjà à l’œuvre.

Défaire le mythe

Pour soutenir le mythe de l’« intelligence artificielle » et minimiser ses dangers, un exemple emblématique est systématiquement mis en exergue : elle serait capable d’interpréter les images médicales mieux qu’un œil humain, et de détecter les cancers plus vite et plus tôt qu’un médecin. Elle pourrait même lire des résultats d’analyses pour préconiser le meilleur traitement, grâce à une mémoire encyclopédique des cas existants et de leurs spécificités. Pour l’heure, ces outils sont en développement et ne viennent qu’en appoint du savoir des médecins, que ce soit dans la lecture des images ou l’aide au traitement.

Quelle que soit leur efficacité réelle, les cas d’usage « médicaux » agissent dans la mythologie de l’IA comme un moment héroïque et isolé qui cache en réalité un tout autre programme de société. Une stratégie de la mystification que l’on retrouve aussi dans d’autres domaines. Ainsi, pour justifier la surveillance des communications, les gouvernements brandissent depuis plus de vingt ans la nécessité de lutter contre la pédocriminalité, ou celle de lutter contre le terrorisme. Dans la mythologie de la vidéosurveillance algorithmique policière (VSA), c’est l’exemple de la petite fille perdue dans la ville, et retrouvée en quelques minutes grâce au caméras et à la reconnaissance faciale, qui est systématiquement utilisé pour convaincre du bien fondé d’une vidéosurveillance totale de nos rues.

Il faut écarter le paravent de l’exemple vertueux pour montrer les usages inavouables qu’on a préféré cacher derrière, au prix de la réduction pernicieuse des libertés et des droits. Il faut se rendre compte qu’en tant que paradigme industriel, l’IA décuple les méfaits et la violence du capitalisme contemporain et aggrave les exploitations qui nous asservissent. Qu’elle démultiplie la violence d’État, ainsi que l’illustre la place croissante accordée à ces dispositifs au sein des appareils militaires, comme à Gaza où l’armée israélienne l’utilise pour accélérer la désignation des cibles de ses bombardements.

Tracer des alternatives

Au lieu de lutter contre l’IA et ses méfaits, les politiques publiques menées aujourd’hui en France et en Europe semblent essentiellement conçues pour conforter l’hégémonie de la tech. C’est notamment le cas du AI Act ou « règlement IA », pourtant présenté à l’envi comme un rempart face aux dangers de « dérives » alors qu’il cherche à déréguler un marché en plein essor. C’est qu’à l’ère de la Startup Nation et des louanges absurdes à l’innovation, l’IA apparaît aux yeux de la plupart des dirigeants comme une planche de salut, un Graal qui serait seul capable de sauver l’Europe d’un naufrage économique.

Encore et toujours, c’est l’argument de la compétition géopolitique qui est mobilisé pour faire taire les critiques : que ce soit dans le rapport du Comité gouvernemental dédié à l’IA générative ou dans celui de Mario Draghi, il s’agit d’inonder les multinationales et les start-ups de capitaux, pour permettre à l’Europe de rester dans la course face aux États-Unis et à la Chine. Ou comment soigner le mal par le mal, en reproduisant les erreurs déjà commises depuis plus de quinze ans : toujours plus d’« argent magique » pour la tech, tandis que les services publics et autres communs sont astreints à l’austérité. C’est le choix d’un recul des protections apportées aux droits et libertés pour mieux faire proliférer l’IA partout dans la société.

Ces politiques sont absurdes, puisque tout laisse à penser que le retard industriel de l’Europe en matière d’IA ne pourra pas être rattrapé, et que cette course est donc perdue d’avance. Surtout, ces politiques sont dangereuses dans la mesure où, loin de la technologie salvatrice souvent mise en exergue, l’IA accélère au contraire le désastre écologique, amplifie les discriminations et accroît de nombreuses formes de dominations. Le paradigme actuel nous enferme non seulement dans une fuite en avant insoutenable, mais il nous empêche aussi d’inventer une trajectoire politique émancipatrice en phase avec les limites planétaires.

L’IA a beau être présentée comme inéluctable, nous ne voulons pas nous résigner. Face au consensus mou qui conforte un système capitaliste dévastateur, nous voulons contribuer à organiser la résistance et à esquisser des alternatives. Mais pour continuer notre action en 2025, nous avons besoin de votre soutien. Alors si vous le pouvez, rendez-vous sur don.laquadrature.net !